How Tariffs Affect Industrial Operations and Real Estate Planning

Tariff policy is increasingly shaping cost structures, operational decisions, and long-term planning. While public discussion often focuses on politics, the practical effects show up in construction pricing, supply-chain adjustments, and location strategy. For many organizations, tariffs are now a standard variable to monitor within financial and operational models.

The following outlines how tariff policy may influence industrial demand, supply-chain behavior, and construction costs over the next several years, as well as the considerations occupiers should be preparing for.

1. Tariffs Are Contributing to Steady Demand for U.S. Industrial Space

Recent tariff measures signal a continued push to bring manufacturing and supply chain functions closer to home. If these efforts persist, they are likely to support moderate to elevated demand for industrial real estate.

Key signals:

- Many companies are reassessing global footprints and moving certain functions back to the U.S.

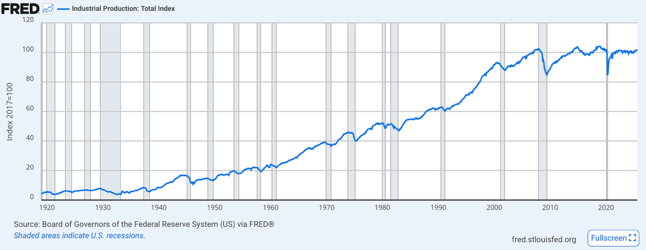

U.S. industrial production has remained stable across multiple tariff cycles. This index does not measure tariffs directly, but it provides a directional signal that domestic manufacturing activity—and therefore demand for industrial real estate—has held steady.

-

Reshoring efforts typically require additional domestic industrial and logistics capacity.

-

Stronger demand tends to increase competition for well-located space and skilled labor.

-

Technology, automation, and AI adoption are rising as companies modernize domestic operations.

Why it matters:

Markets with established manufacturing ecosystems may experience tightening conditions, firmer rent trajectories, and faster absorption as reshoring activity continues.

2. Timing: When Tariff Effects Will Influence CRE

Tariff policy is still early in its cycle. The pace and scale of impact will depend on international negotiations and how companies adjust supply chains.

Directional timing:

-

Initial effects may appear within 6–12 months as procurement strategies shift.

-

More material changes are likely over 12–36 months, depending on how policy deadlines evolve.

-

Negotiations may extend timelines, which could delay or moderate the impact.

-

Early signs of increased activity can already be seen in markets tied to major manufacturing growth (e.g., semiconductor-driven expansions in Phoenix).

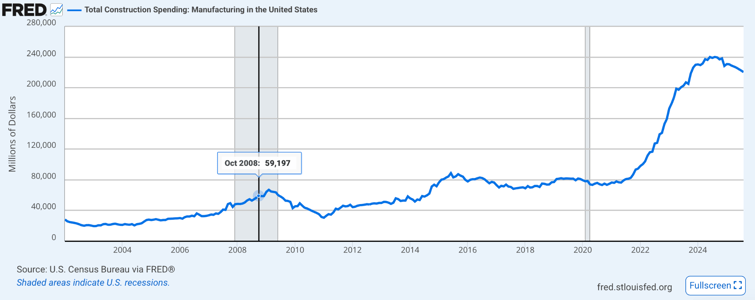

This chart shows how U.S. manufacturing construction spending has risen over multiple years — a trend that often begins after major trade-policy changes.

What occupiers should expect:

Industrial demand changes tend to build gradually, but once established, they typically remain durable. Planning ahead for multi-year adjustments is essential.

3. Construction Costs: Potential Upward Pressure

A core question for occupiers is whether tariff policy will contribute to higher construction costs. Current indicators suggest some upward pressure is possible.

Key considerations:

- Tariffs may increase the cost of various materials used in industrial and manufacturing facilities.

- Rising domestic demand for projects can strain labor availability and supply chains.

- If activity accelerates, pricing pressure could build: more projects → tighter labor → higher costs.

- Final outcomes will depend on which materials receive tariff relief and how trade agreements develop.

Implications for occupiers:

Align budgets with conservative assumptions, and validate landlord cost estimates with independent experts. Elevated pricing may continue until supply chains adjust.

4. Strategic Implications for 2026 and Beyond

If tariff-related policies continue to evolve, occupiers should monitor several areas that directly influence operations, timelines, and long-term strategy.

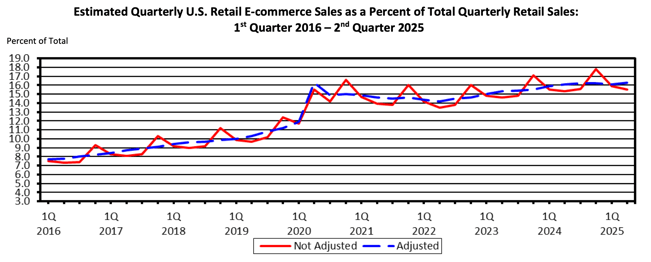

As e-commerce keeps growing, it continues reshaping how goods move and where modern industrial space is needed most

Supply Chain Shifts

Reshoring and nearshoring decisions will influence distribution models, supplier networks, and preferred manufacturing corridors.

Rent and Vacancy Trends

Low-vacancy markets may remain tight or tighten further, particularly near ports, key logistics routes, and advanced manufacturing ecosystems.

Site Selection Drivers

Labor access, energy availability, transport infrastructure, and supplier proximity will hold greater weight in location decisions.

Capital Planning

Construction inflation, extended build timelines, and material variability will influence expansion and renewal strategies.

5. What Occupiers Should Do Now

-

Strengthen scenario planning.

Model tariff-related cost exposure across labor, materials, logistics, and facility needs. -

Protect renewal timelines.

Early positioning is increasingly important in markets experiencing pricing or supply pressure. -

Reevaluate your supply chain footprint.

Identify where tariffs introduce operational strain and where domestic positioning may add resilience. -

Pressure-test build-to-suit assumptions.

Construction inputs may fluctuate. Independent cost verification reduces risk. -

Stay close to real-time market signals.

Policy changes can shift quickly; local intelligence helps occupiers respond effectively.

Final Takeaway

Tariffs are becoming a structural influence on industrial demand, construction pricing, and long-term supply chain strategy. The effects will not be immediate or uniform, but they will shape decision-making across multiple cycles.

Occupiers that monitor policy developments, assess cost exposure, and plan ahead are better positioned for stability. Those that delay adjustments may face tighter supply, higher costs, and fewer strategic options over time.