Over the past few weeks, the Fed has been vocal about the growing possibility of pulling back on stimulus earlier than anticipated as some Board members have concerns over inflation.

Over the past few weeks, the Fed has been vocal about the growing possibility of pulling back on stimulus earlier than anticipated as some Board members have concerns over inflation.

With regard to inflation, the Fed remains caught between a rock and a hard place. If inflation remains well above trend, the Fed will remove accommodative policies, creating a significant risk to the overall recovery, particularly for industries like commercial real estate that have yet to recover from the pandemic. Using the office sector as an example, the current lay of the land is materially weak from my perspective. In addition to the growth of remote work, numerous companies have pulled back on office re-entry plans due to the Delta Variant, and many employees are becoming more comfortable working from home. As an example, PwC recently updated their remote work survey from January. 41% of employees surveyed said they would like to stay at home full time, up from 29% in January. It continues to feel like the longer social distancing lasts, the weaker the environment will be for commercial real estate across numerous property types.

Economic numbers have started to show some weakness over the past several weeks, making matters more challenging for the Fed. Growing fears surrounding the Delta Variant and inflation are the primary drivers behind this weakness, but less stimulus and declining demand also seem to be factors at play. This week’s economic numbers were mixed overall, with the following reports most noteworthy from my perspective:

University of Michigan Confidence: This Index for Consumer Sentiment fell to 70.3, the lowest level since 2011 due to the aforementioned concerns over the Delta Variant and inflation. This weakness implies weaker spending numbers over at least the next couple of months:

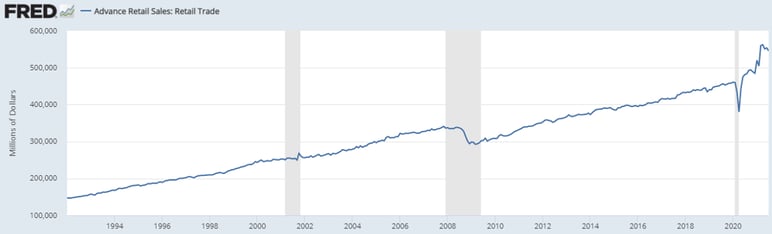

Retail Sales: August’s retail sales fell more than anticipated, down 1.1% vs. expectations of a drop by .3%. The good news here is Retail Sales remain well above the pre-Covid trend:

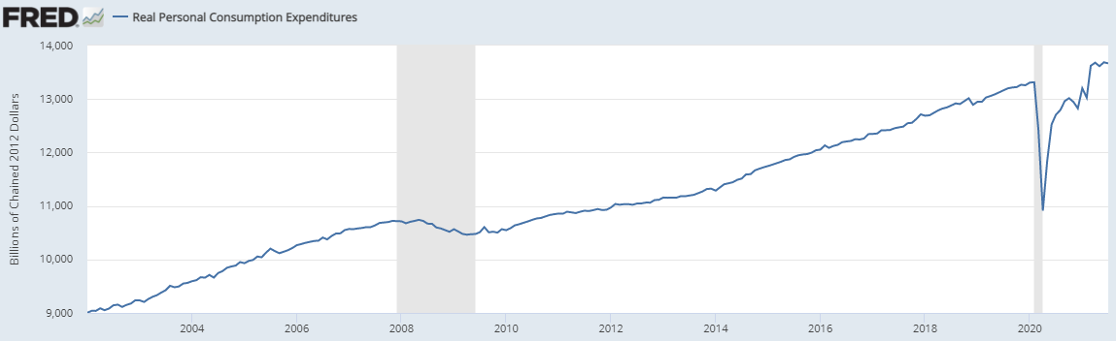

Despite massive amounts of stimulus and a strong economic recovery, unlike retail sales, many other data releases are unfortunately below or only equal to their pre-Covid trends. For example, today’s Personal Consumption Expenditures report qualifies as data that has only been able to get back to trend despite trillions in stimulus efforts by the Fed and Congress:

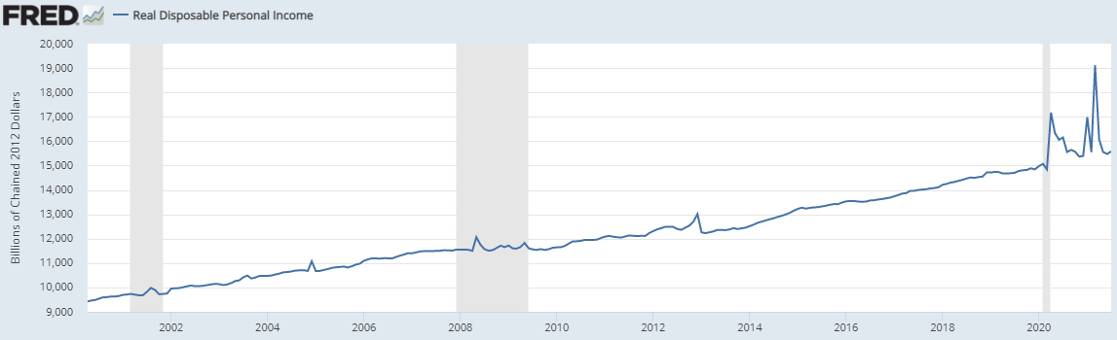

Real Personal Income increased by 1.1% on the month, above expectations, but still only at its pre-Covid trend:

The same is true for Real Personal Consumption Expenditures, which matched expectations, rising by .3% on the month and still only back at its long-term trend:

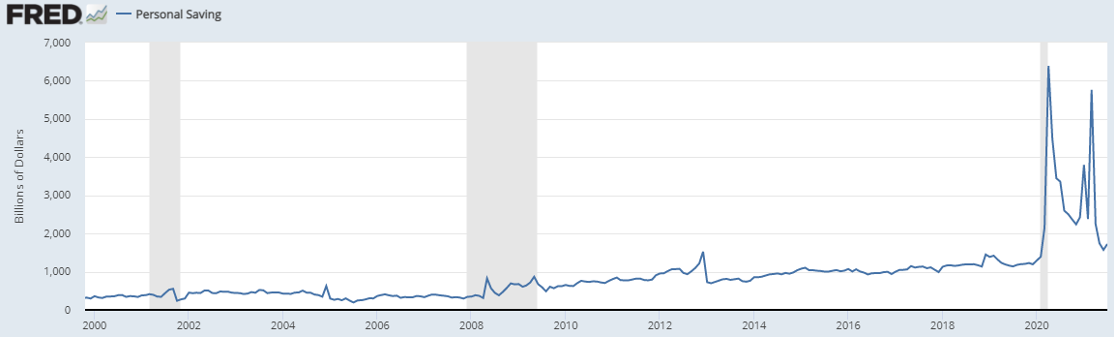

Personal Saving remains marginally elevated compared to its long-term trend:

Seeing charts normalize after the past year and a half provides a certain comfort level. Still, the concern here is if stimulus is taken away more significantly, what happens to this data? Can spending, income, and savings stay on trend without stimulus? It’s tough to say.

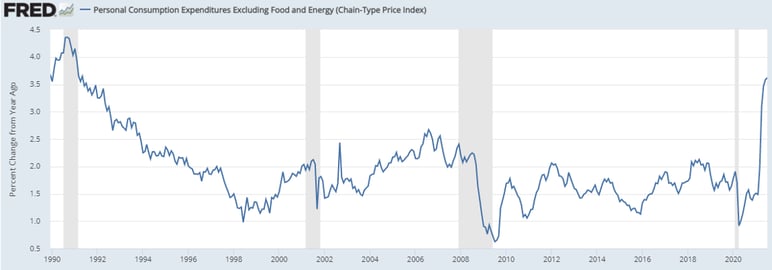

Within this data series, some charts are also downright concerning. As previously mentioned, inflation numbers have scared many, with numbers well above recent history. Massive stimulus (and other factors like supply chain disruption, base effects, pent-up demand, and a currently disjointed labor market) has helped push inflation metrics to their highest levels in 30 years. Looking at the Fed’s preferred inflation gauge, Core PCE (year on year), inflation remains near its highest level since the early 1990s and well above the Fed’s historical comfort zone of 2%:

Coronavirus variants and inflation continue to pose the most significant predictable risks for the economy and, ultimately, commercial real estate. Unfortunately, many users of space feel overwhelmed by the uncertainty surrounding this pandemic when making real estate decisions. From my perspective, to make sensible short- and long-term real estate decisions in this environment, it has become much more important to understand these economic numbers than during ‘normal times.’