With November’s CPI showing the largest price pressures since the 1980’s last week, the market continues to be hyper-focused on drivers of inflation pressures.

One area that is getting a lot of attention has been wage inflation. Wages have been rising in 2021 mainly due to a lack of available labor, heavy stimulus, and a massive number of job openings with the U.S. economy in recovery over the past year.

A popular narrative in the market is that rising wages are great because it means people have more money to spend on goods and services. While I love the sound of rising wages myself, the story isn’t so great for wage earners today. Despite rising wages, inflation is rising at a faster rate than wages; meaning purchasing power for wage earners is actually falling.

As an example, let’s take a look at two charts provided by the Bureau of Labor Statistics over the past week and a half.

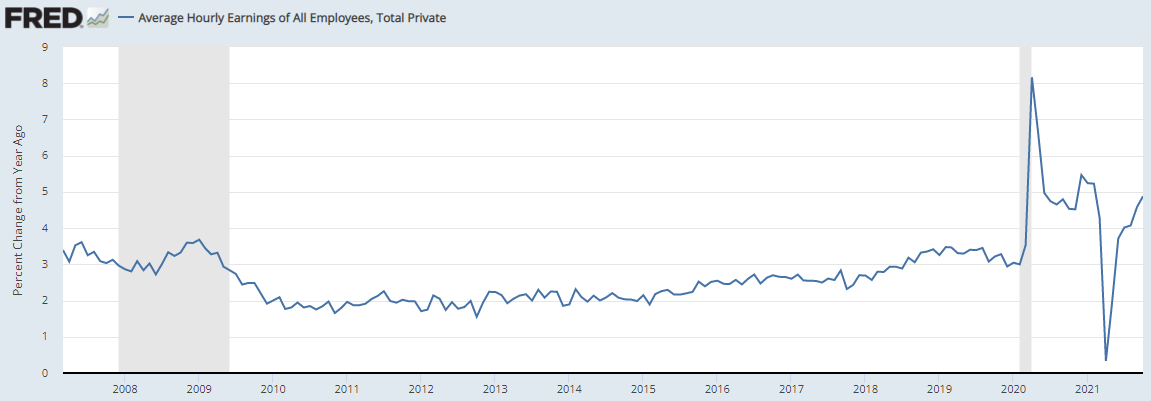

First, November’s average hourly earnings numbers showed material earnings growth in October. Average Hourly Earnings now sit right around 5% in terms of annual growth compared to a long term average of 2.7%:

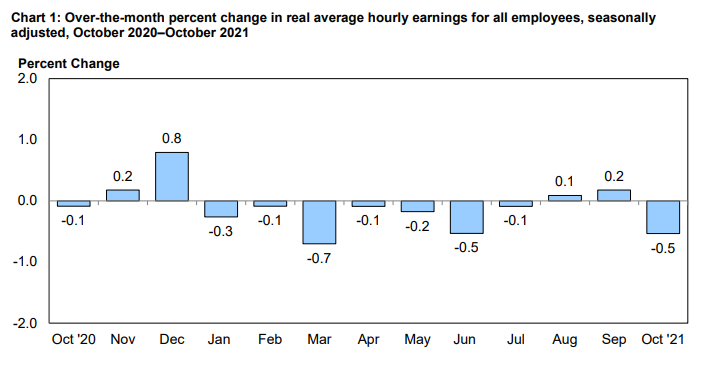

Looks great, right? But, look at earnings when adjusted for inflation on a monthly basis over the past year:

Average Hourly Earnings (adjusted for inflation) over the past year is actually down 1.3%. Purchasing power has been weaker over the past year despite heavy spending and the recovery.

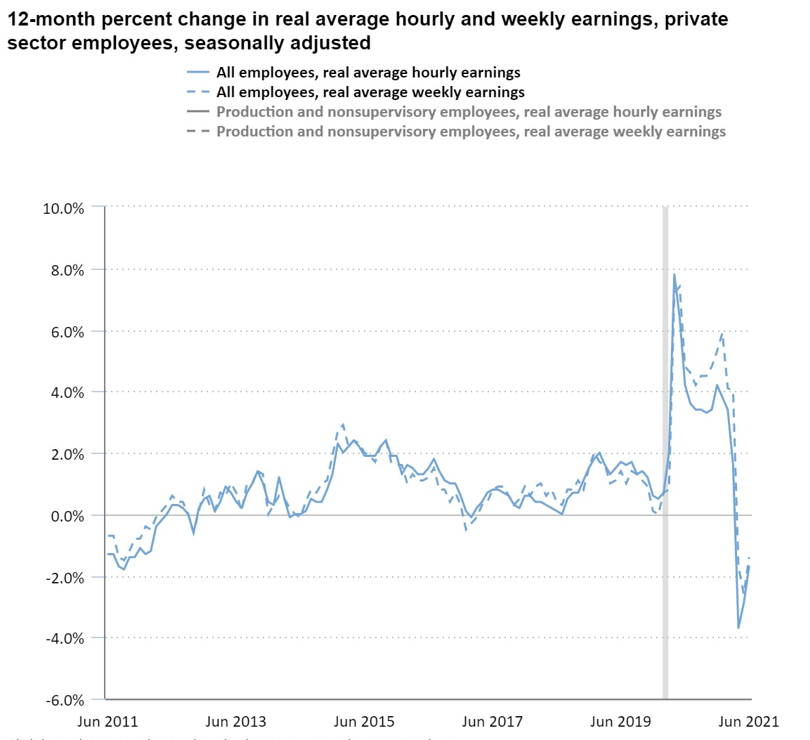

The following chart shows a longer term history of Average Hourly Earnings (adjusted for inflation):

From 2013-2019, inflation adjusted average hourly earnings were positive, and I think most people would agree that the 2013-2019 period felt like a pretty healthy period for our economy as a whole.

In many ways, a lot of the fears surrounding inflation and the recovery would disappear if we could just get inflation adjusted earnings to turn positive.