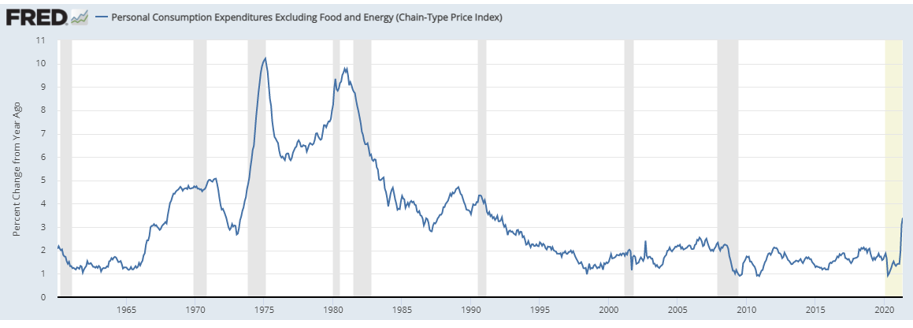

This week, we received June’s Consumer Price Index (CPI) and Producer Price Index (PPI) numbers showing inflationary indicators once again beating expectations. Annual core (ex-food and energy) inflation rates are currently well above the Fed’s comfort zone of 2% (pictured below), and currently, sit at their highest levels since the early 1990s.

Many expected inflation to rise in 2021 due to increased stimulus efforts, pent-up demand from the reopening, and base effects (strong annual growth rates from weaker 2020 inflation readings). However, supply chain bottlenecks and wage pressures were somewhat unexpected and this mix of overall inflation pressures has many nervous about longer-term price increases. As debates continue regarding the rising inflation rate's impact on the economy, what can these pressures mean for commercial real estate?

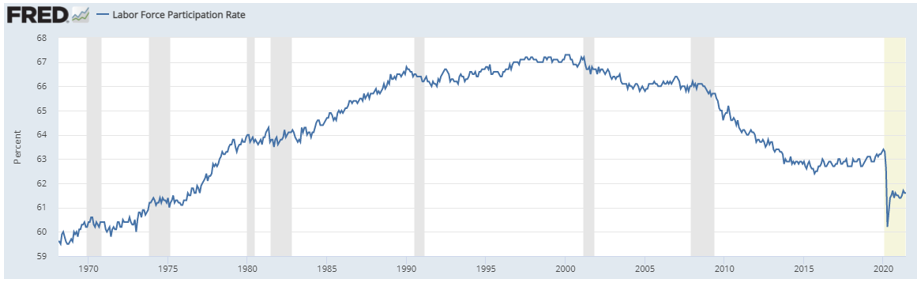

According to the Bureau of Labor Statistics, job openings are highest in the Food Service, Arts, and Entertainment industries. Additionally, hourly earnings have risen most in the Leisure and Hospitality, Information, and Retail Trade industries. As stimulus efforts like pandemic unemployment benefits dissipate over the coming months, some of this labor shortage/wage pressure should cure with many employees coming back to work. However, some indicators argue for a longer-term wage problem. As an example, despite the reopening, the Labor Force Participation Rate (pictured below), has shown virtually no improvement over the past 12 months, arguing that many have left the workforce completely, limiting the supply of available labor.

To combat these potentially longer-term wage pressures, businesses can raise prices of goods and services, automate operations, or lower costs elsewhere. Given the growth of remote capabilities across the economy, if these wage pressures continue, many businesses may choose to incorporate more remote capabilities and cut back on real estate costs rather than raising prices. This maneuver would allow businesses to remain competitive within their respective industries. If this real estate cost-cutting occurs, vacancy rates will continue to rise, adding to rental rate weakness across numerous property types within the commercial real estate sector.