Second to the Delta Variant, inflation continues to be the biggest risk to the economic recovery. Over the past week, we have received numerous economic data releases which continue to support the narrative that inflation is a concern.

Second to the Delta Variant, inflation continues to be the biggest risk to the economic recovery. Over the past week, we have received numerous economic data releases which continue to support the narrative that inflation is a concern.

It’s important to preface why inflation is such a worry. In a nutshell, rising prices hurt purchasing power, can beget further price increases, and create more dislocation between the ‘haves’ and ‘have nots’ throughout our economy. Regarding this last point, owners of assets or those who make substantial income can withstand rising prices. Those who lack assets or income will likely struggle to make ends meet. As it pertains to users of space in commercial real estate, those tenants who are experiencing rising prices in terms of input costs can choose to raise the prices of their goods and services or they can cut costs in other areas to remain competitive. At the same time, businesses that cannot afford to pay higher input costs, cut costs, or raise prices will likely struggle to remain solvent altogether. With remote capabilities more prevalent today, if inflation remains elevated, we see many retail and office users electing to incorporate more remote capabilities to better manage their bottom line. From our perspective, rising inflation will negatively impact the demand for space, forcing vacancy rates to rise further in numerous areas across commercial real estate.

Now to the data…..

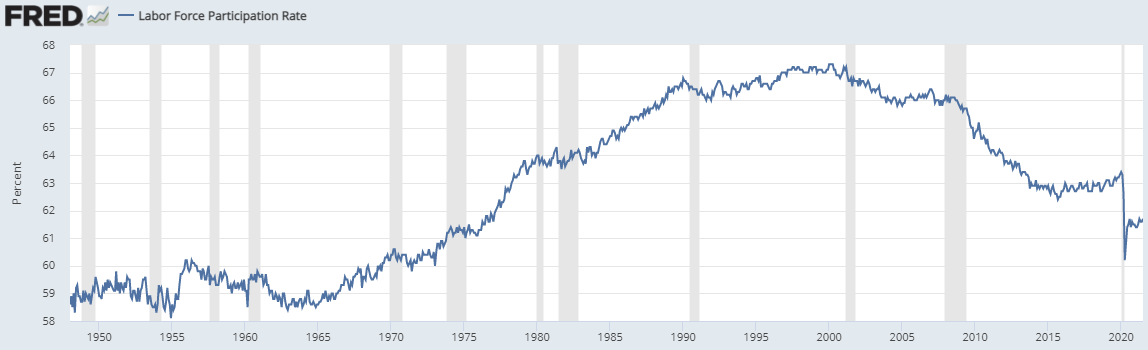

August’s Nonfarm Payrolls: Job creation continued with a net of 943,000 jobs created in July, and the Unemployment Rate fell substantially to 5.4%, well below its historic rise to 14.8% in April 2020. This is great news in terms of the recovery, but the report showed material inflation pressures as well. Average Hourly Earnings rose .4% for the month, up a substantial 4% over the past year, well over the pre-Covid annual average of only 2.5%. Additionally, the Labor Force Participation Rate continues to show a smaller pool of available labor, remaining depressed at 61.7% and still within a range we last witnessed in the late 1970s (pictured):

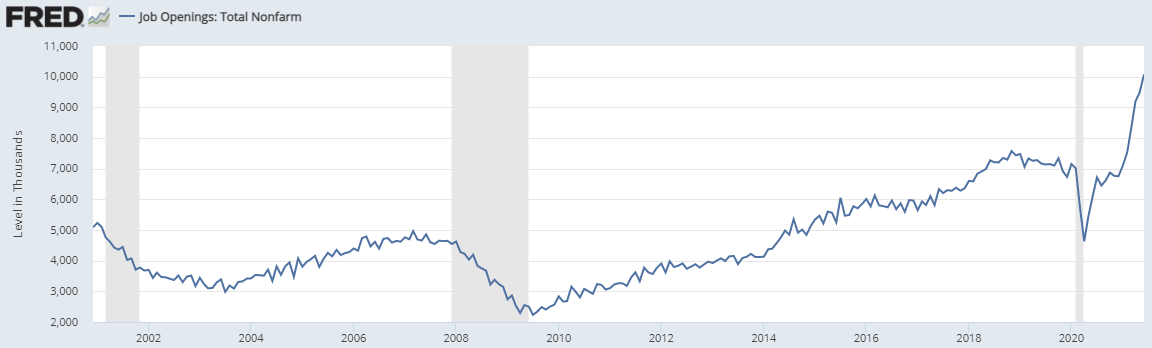

JOLTS (Job Openings and Labor Turnover Survey): Despite the growth in jobs created in July, the number of job openings continued to break into new record territory. This week, 10.1 million job openings were reported from the Bureau of Labor Statistics (pictured). While many try to explain away the reasoning for these openings (i.e. Covid fears, generous unemployment benefits, skills mismatch…..), the simple fact is this elevated number of openings forces employers to raise salaries to entice job seekers. This record-high number of job openings should continue to support elevated wage inflation over at least the coming months.

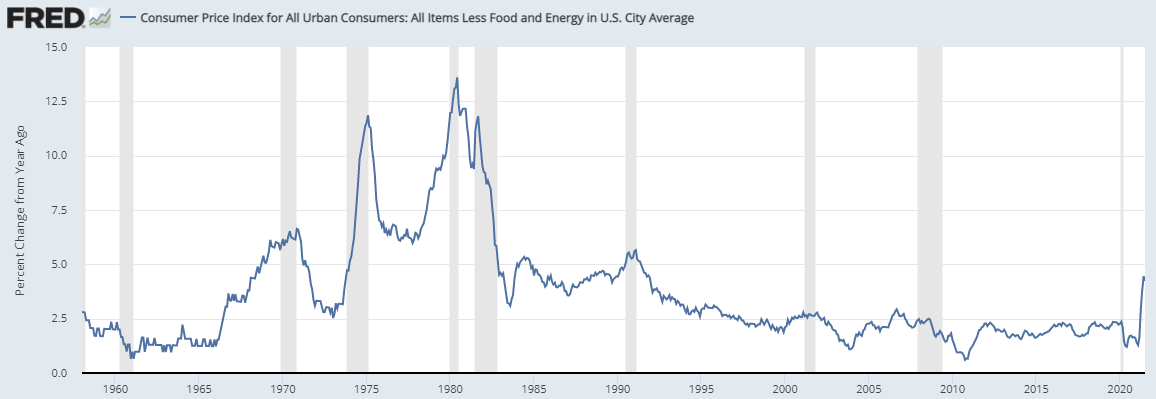

CPI: The price of goods and services continued to rise well above recent history with the CPI headline number printing above 5%, and the historically less volatile Core number (Ex: Food and Energy) printing above 4%. For context, the Fed typically shoots for an inflation number of 2% annual growth. A Core number of around 4% is historically high and a number we have not witnessed since the early 1990s (pictured):

PPI: Finally, input costs continue to rise. Final demand prices (prices received by domestic producers for goods, services, and construction) rose 1% in July and is now up 7% on an annual basis, the highest on record:

While some of these charts are concerning, please be mindful that base effects (price weakness in 2020), stimulus, supply chain issues, and pent-up demand have all helped push prices up in 2021. If the Fed is correct, and these pressures are transitory (short term), the recovery will likely continue healthily. If these pressures are longer-term in nature, it will have a much more serious negative impact on our Economy. Longer-term price pressures will force the Fed to pull back on stimulus to slow the economy and control price increases. In this scenario, industries like commercial real estate will start to feel pressure from less liquidity and spending in the financial system.

All data has been sourced from the FRED, Federal Reserve Economic Data.