Economic data has been strong in 2021, but as a nation, we are far from being out of the woods.

Economic data has been strong in 2021, but as a nation, we are far from being out of the woods.

Government and Fed stimulus have supported the economy and commercial real estate, but the Delta Variant and inflation fears have become material risks. Ultimately, for the economy (and commercial real estate) to weather this storm, we need the pandemic to dissipate, the economy to maintain steady growth, and inflation to remain contained.

Beyond the obvious Delta Variant concerns, the Fed is entering a challenging stage of balancing stimulus and inflation.

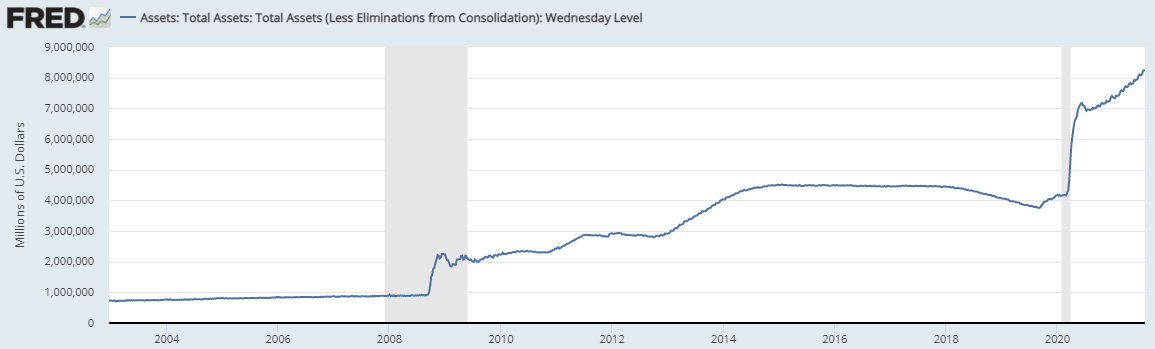

Starting with stimulus, our economy continues to be supported by massive quantities of easy money. In addition to a low Federal Funds rate and $6 trillion in government stimulus provided over the past 16 months, the Fed has been purchasing $120 billion per month in Treasury and mortgage debt, keeping rates low and infusing our financial system with money. To get a sense of how much the Fed has supported markets and the economy, take a look at the jump in their current balance sheet:

The Fed’s balance sheet is up roughly $4 trillion dollars since the start of the pandemic, double the support needed coming out of the Global Financial Crisis.

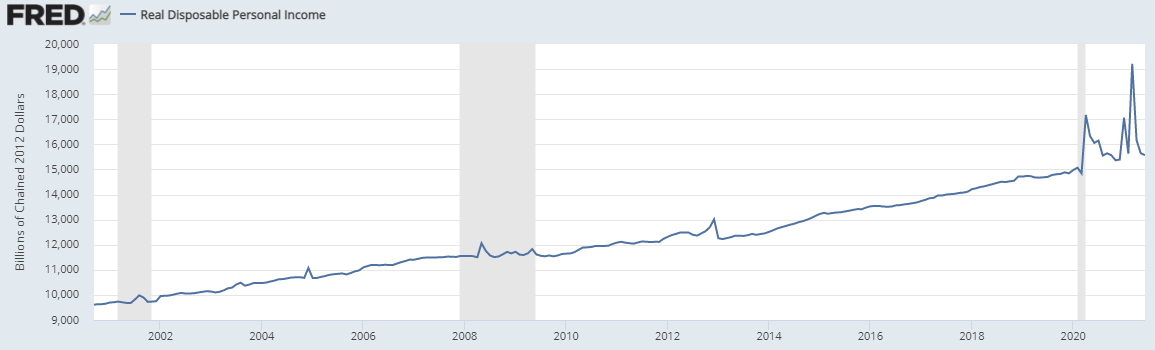

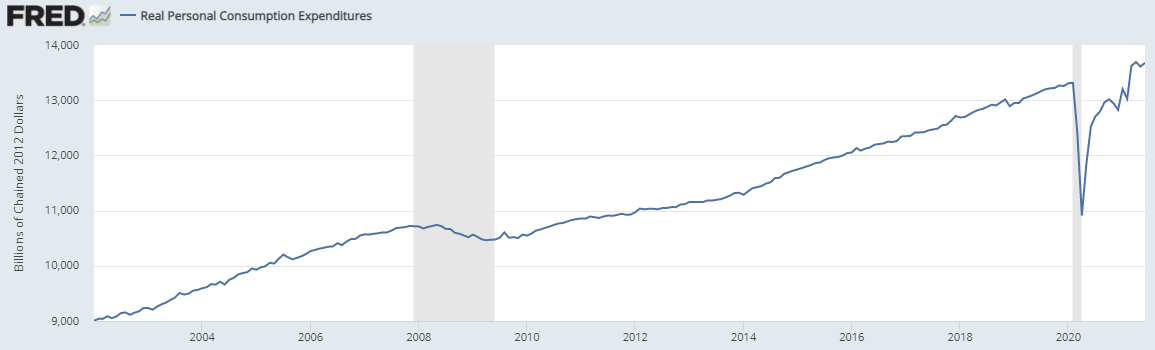

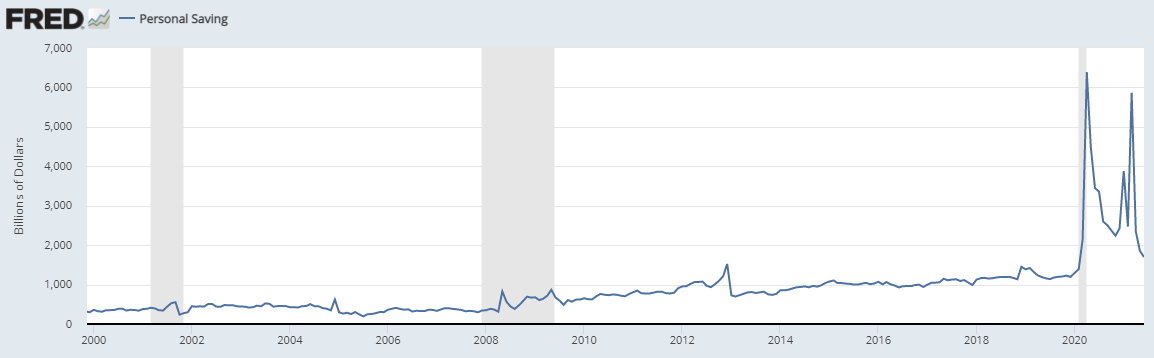

The result of this stimulus has been strong economic numbers in 2021, but in many ways, we’ve only been able to get back to trend as an economy. Looking at today’s Personal Consumption Expenditures report, personal income and spending are back to normal with savings a bit elevated:

Real Personal Income:

Real Personal Consumption Expenditures:

Personal Saving:

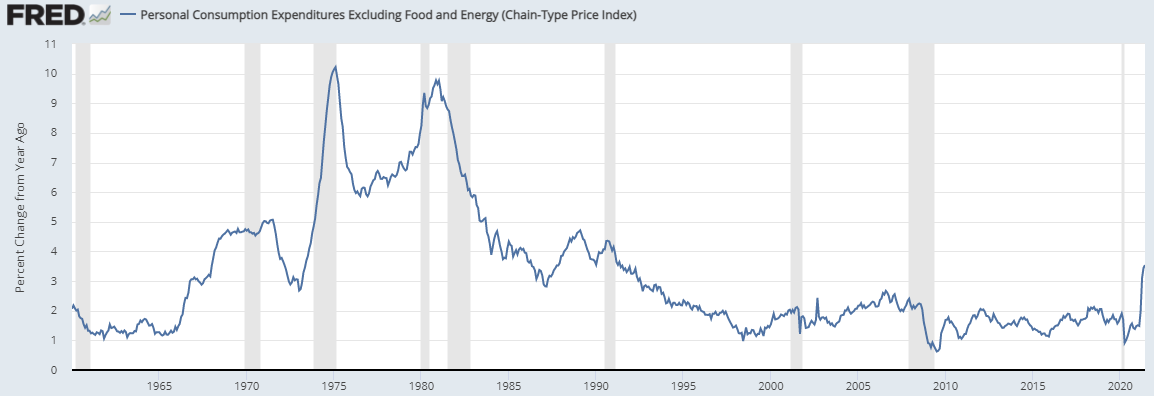

Seeing charts normalize after these past 16 months provides a certain level of comfort, but not all charts look so reassuring. As an example, inflation numbers have spiked. Massive stimulus (along with other factors like supply chain disruption, base effects, pent-up demand, and a currently disjointed labor market), has helped push inflation metrics to their highest levels in 30 years.

Inflation is currently at its highest level since the early 1990s:

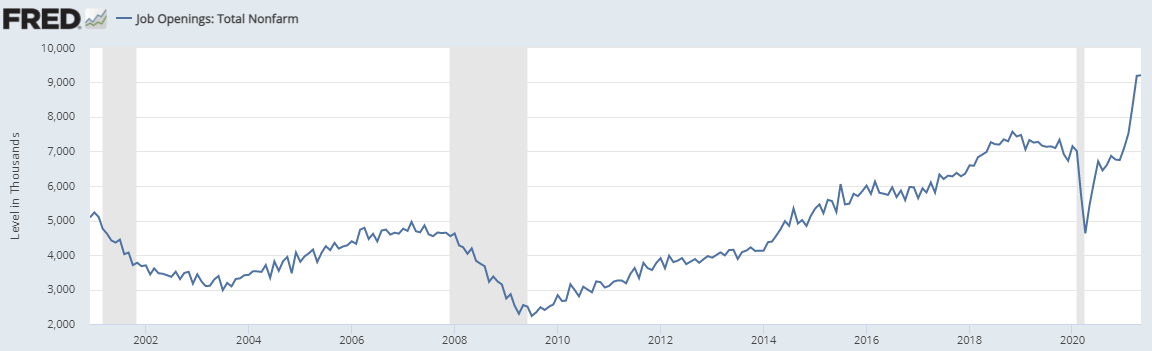

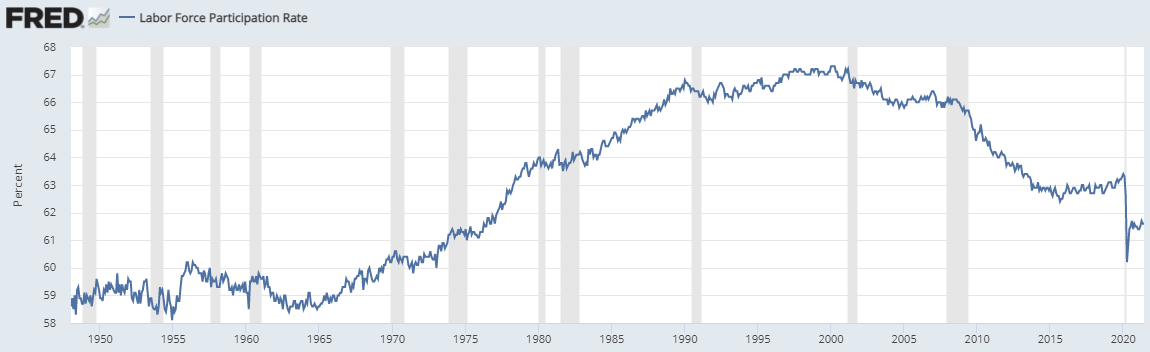

The Fed continues to state they view inflation risks as a short-term challenge, but wage inflation continues to look like a longer-term issue. Currently, there is a lack of labor supply with a historic number of job openings and a Labor Force Participation Rate back down to 1970’s levels:

Job Openings:

Labor Force Participation Rate:

You can expect some normalization of these charts as unemployment benefits expire, but if these charts maintain their recent trends, businesses will likely have to boost wages further to maintain their employee base. An environment with elevated prices and elevated labor costs does not set the stage for transitory inflation. In this scenario, given remote capabilities, many businesses may elect to cut costs in areas like commercial real estate to maneuver around rising labor costs; an argument for rising vacancy rates beyond what we’ve already witnessed to date in the office sector as an example.

We’re entering a challenging stage of this recovery. Inflationary pressures are forcing the Fed and Administration to rethink stimulus, while the Delta Variant is reigniting concerns for the overall economy. The economy has recovered well thus far in 2021, but risks remain elevated. As it stands right now, we need to see normalization across the employment, inflation, and virus-related metrics to feel more comfortable about the direction of both the economy and commercial real estate.

Even in this scenario, please be mindful that commercial real estate should continue to face obstacles with vacancy rates up across numerous property types, spending habits changing, and the ongoing growth of remote capabilities. The way we use space is changing, regardless of broader economic trends.