Once again, we’re starting to see numerous headlines written about “the office market recovery.” Specifically, we’re seeing articles highlighting the decline in the amount of sublease space on the market or better leasing performance in H2 of 2021. Additionally, over the coming weeks, I suspect we’ll begin to see an increase in support for the ‘office market’s recovery’ as Omicron variant case numbers decline and more people come back into the office.

While less sublease space, improving leasing statistics, declining Covid cases, and ultimately more foot traffic may all be accurate, do these storylines accurately explain the current state of the office market? Unfortunately, the short answer is no.

Not only is the office sector currently under pressure, but fundamentals and changing office usage trends argue for prolonged challenges for this property type.

Starting with fundamentals, vacancy rates are historically high, sublease space remains in pre-Covid record territory, and the economy, which has been supported by stimulus over the past two years, is now facing major headwinds.

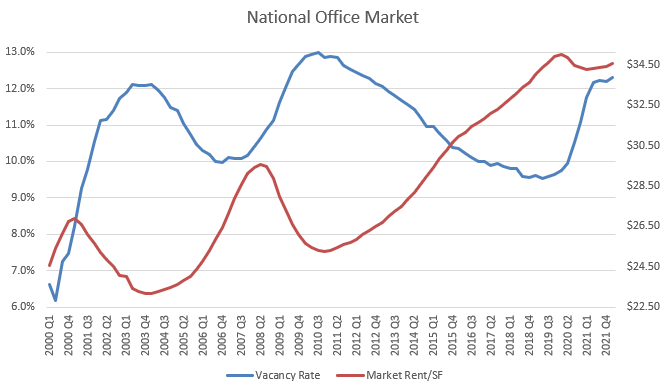

In terms of fundamentals, starting with vacancy rates, on a national level, we’re currently right around the highest levels of the past 20 years (blue line in the chart below):

Historically, whenever vacancy rates have reached these levels, national rental rates have fallen significantly and much lower than today’s rates. However, this time, base rents haven’t dropped much on a national level, so what gives?

Since the start of the pandemic, many have been hoping for a quick return to a ‘back to normal’ environment. Even after two years, this hope remains for many people and businesses, and landlords are no exception. Whether right or wrong, pandemic uncertainty is a reason why many landlords have held off dropping base rents. The long-term negative impact of lowering rental rates for landlords can be significant, which is why it’s the last resort for many landlords.

Another reason why we have not witnessed such a large drop in base rents over the past two years is due to heavy amounts of stimulus provided by the Government and Fed to support the overall economy. The financial system has been flush with cash to help numerous office users and owners keep operations somewhat stable. This support has limited further vacancy pressure, keeping base rents somewhat higher than they otherwise would have been.

And finally, one last reason we haven’t seen base rents fall much is because landlords have elected to provide concessions in other areas like tenant improvements and free rent. Offering TI and free rent allows landlords to offer a discount to a tenant without hurting the long-term cash flows of a property. Although base rents haven’t moved much, effective rental rates (rental rates after deducting the value of concessions) have fallen. According to REIS, currently, there is approximately a 20% difference between asking rents and effective rents, a high since 2010.

So base rents haven’t moved much thus far, but a strong argument can be made that they will decline further over time based on three factors; supply/demand, economic data, and human behavior.

In terms of supply and demand, not captured in vacancy numbers, is the historically high levels of sublease space currently on the market—roughly 170 million square feet, according to CoStar. The pre-Covid high for sublease space on the market was close to 140 million square feet in 2009. Since sublease space is typically offered at a rental rate discount of 25-30% lower than direct space asking rents, downward pressure on rental rates should continue until this excess sublease space dissipates.

Additionally, the economic environment is starting to look arguably weak. Stimulus is being pulled from the system, and the Fed is about to hike rates.

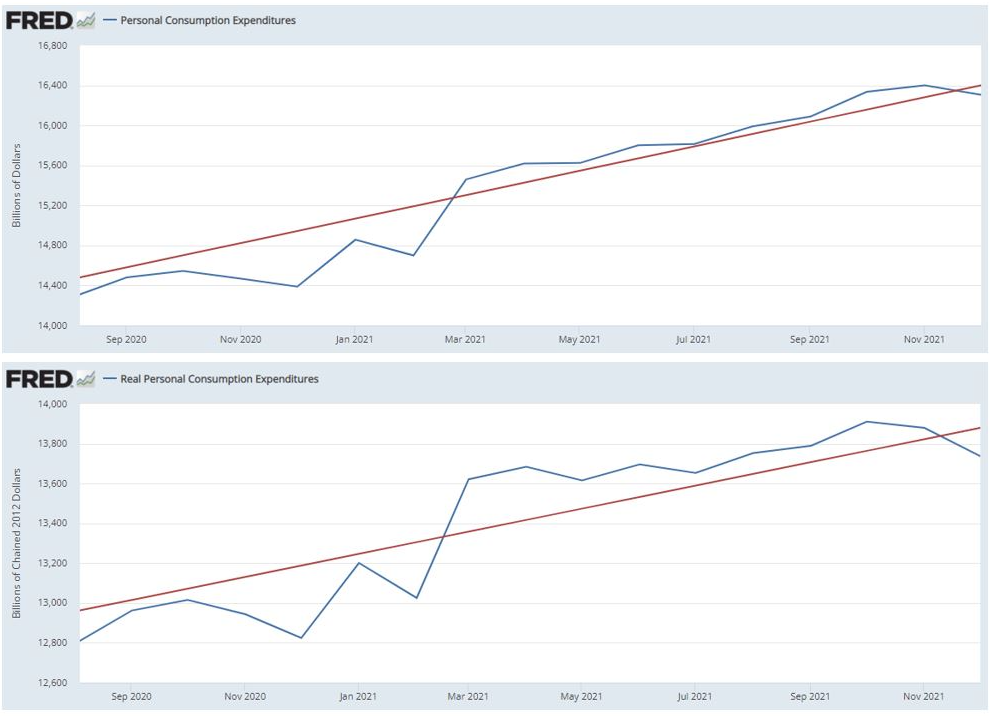

Spending, which had been supporting the recovery, has already begun to decline. Moreover, spending should decrease with the Fed hiking rates, further impacting performance across many businesses, industries, and property types. In terms of recent spending data, the past couple of months have shown spending (nominal and adjusted for inflation) falling below its long-run trends:

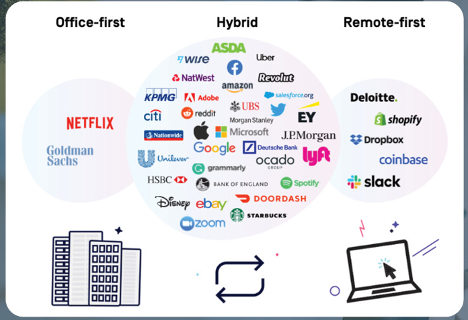

Another reason to have concerns about the office sector has been the growth of the hybrid work model. The following graphic from HubbleHQ.com, represents how most large organizations are responding to the pandemic. The clear popular choice has been the hybrid model with a mix of in-office and remote working capabilities.

Compared to the “in-office full time” approach, the hybrid model provides cost savings, efficiency, and offers a better work/life balance for many individuals. It allows for in-office activities for training, collaboration, and culture. At the same time, it provides flexibility for those who need to tend to personal matters or who can work efficiently and effectively from outside the office.

Most people want the option to work remotely, and this is true even for employees who like being in the office 60 hours a week. For example, in a survey conducted by PWC in January 2021 across 1,200 employees and 133 executives, 92% of employees and 83% of executives requested some amount of remote work incorporated into their careers. Many other surveys since January 2021 continue to support this narrative as well.

With many companies now offering this flexibility, businesses that do not offer workplace flexibility may struggle to recruit and acquire talent. Once again, relying on economic data for support, the current state of the job market is showing a material lack of skilled labor with a near-record number of job openings throughout the United States:

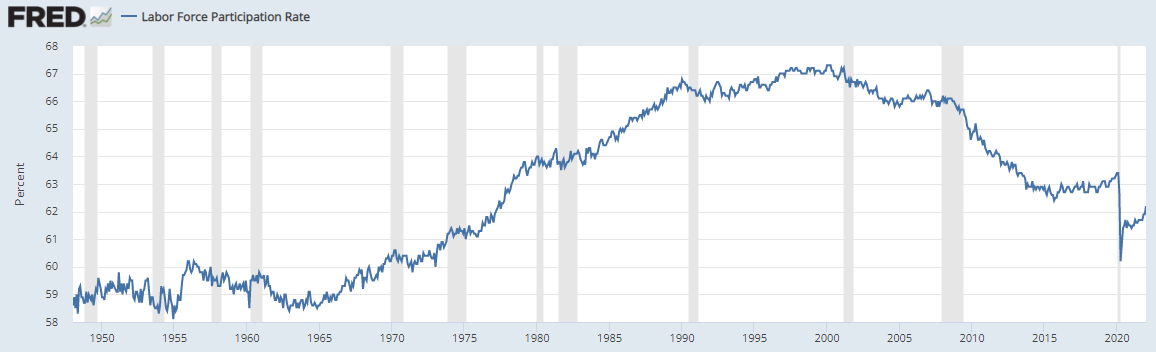

This lack of available labor also looks to follow a long-term trend, supported by retiring Baby Boomers. The Labor Force Participation Rate continues to report that many people have left the workforce entirely since the start of the pandemic. The current participation rate stands at only 62.2%, near the low pre-Covid low of the past 40+ years:

With a lack of available labor seemingly a longer-term issue, we’re seeing rising wages and employers offering new incentives to acquire talent, including remote work capabilities. Having remote work offerings is not only an employee perk, but it also allows an employer to pull talent from other regions, a necessity in today’s market where finding employees is becoming more challenging.

Another byproduct of rising wages is that companies may cut costs in other areas to manage their bottom line. For example, real estate costs are typically the second or third largest expense for businesses, and lease rates remain near historic highs. With remote capabilities so mainstream now, shrinking office footprints and cutting real estate costs become attractive options for many organizations, especially with the inflation pressures we are seeing today. In addition to the glut of office supply already on the market and the growth of remote working capabilities, wage inflation may lead to further upward pressure on vacancy rates and downward pressure on rental rates moving forward.

Be wary of articles highlighting that the office sector is recovering strongly from my perspective. Inherently, there is less of a need for office space today than what we are used to seeing. The office sector is by no means dying, but it is going through a contraction that will likely take years to play out.