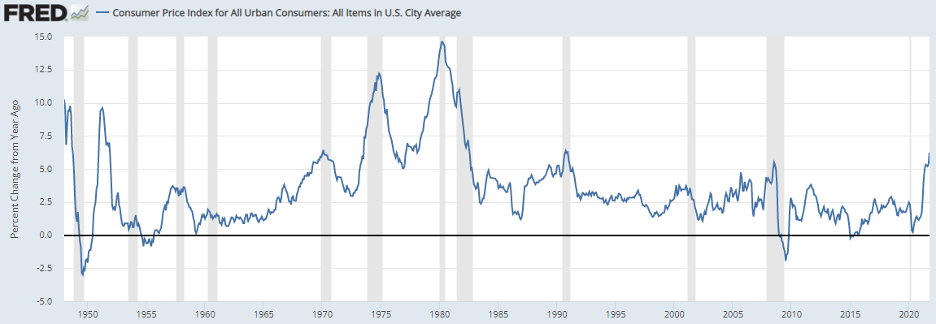

As we continue to monitor commercial real estate fundamentals and the economic recovery, inflation is now a significant concern. Inflation is a problem because if prices rise dramatically, the purchasing power for most Americans suffers, despite the recovery.

Continued elevated inflation will ultimately hurt spending and potentially force the Fed to raise rates more aggressively, limiting the upside potential for all industries, including Commercial Real Estate. The massive amount of stimulus provided by Congress and the Fed, supply chain pressures, pent-up demand, and wage inflation due to a lack of available labor have all driven inflation pressures.

This morning, we received CPI data for November, and inflation numbers continue to trend in the wrong direction, now approaching numbers we last witnessed in the 70's and 80's. Headline CPI Year on Year is now up over 6%:

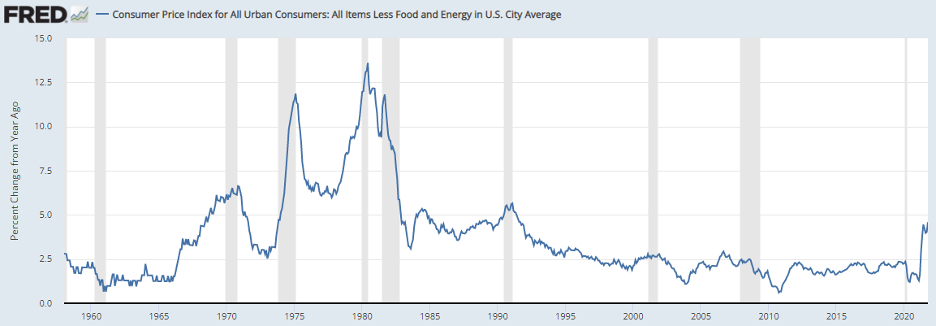

Core CPI (Year on Year), which excludes volatile sectors like Food and Energy, is up over 4.5%:

When considering how these pressures can impact Commercial Real Estate, look no further than the retail and office sectors. Regarding retail, if inflation and/or a restrictive Fed policy hurts spending, small businesses may struggle to make ends meet, leading to store closures, particularly in the face of rising wage pressures.

When considering how these pressures can impact Commercial Real Estate, look no further than the retail and office sectors. Regarding retail, if inflation and/or a restrictive Fed policy hurts spending, small businesses may struggle to make ends meet, leading to store closures, particularly in the face of rising wage pressures.

Regarding office, a combination of weakened spending and the growth of remote capabilities may cause businesses to incorporate more remote practices to manage costs moving forward, contributing to a lower overall demand for space.

I don’t anticipate inflation will skyrocket from here, but it is a problem that can be difficult to control. Considering the current supply chain problems and wage inflation pressures that appear to be longer-lasting, the Fed may be forced to raise rates in early 2022 to limit spending and control these price pressures. Typically, the Fed likes inflation to hover around 2%, and numbers in the 4%-6% range are not healthy, particularly when you consider that wages are not keeping up with rising prices.

Current market expectations are for the Fed to raise rates in the Summer of 2022, but if these inflation numbers remain elevated, expect the first rate hike to occur sooner.