We’ve entered an interesting phase of the recovery. With massive government stimulus over the past 18 months and the Fed likely announcing the taper of asset purchases this week due to inflation concerns, the recovery will be tested. Can spending remain healthy without stimulus checks and enhanced unemployment benefits, and the Fed pulling back on flooding the financial system with cash? Can the recovery continue in the face of inflation pressures? The training wheels supporting the economy are clearly coming off.

By examining October's spending data, it’s reasonable to question how strong spending will be over the next 12 months, but spending trends don’t seem to be generating too many alarm bells at the moment. Instead, much of the commentary surrounding October’s economic data focused on a tight labor market, elevated inflation levels, and weaker confidence in the economy. The following three charts may best visualize this sentiment:

Tight Labor Market: Job openings remain near historic highs

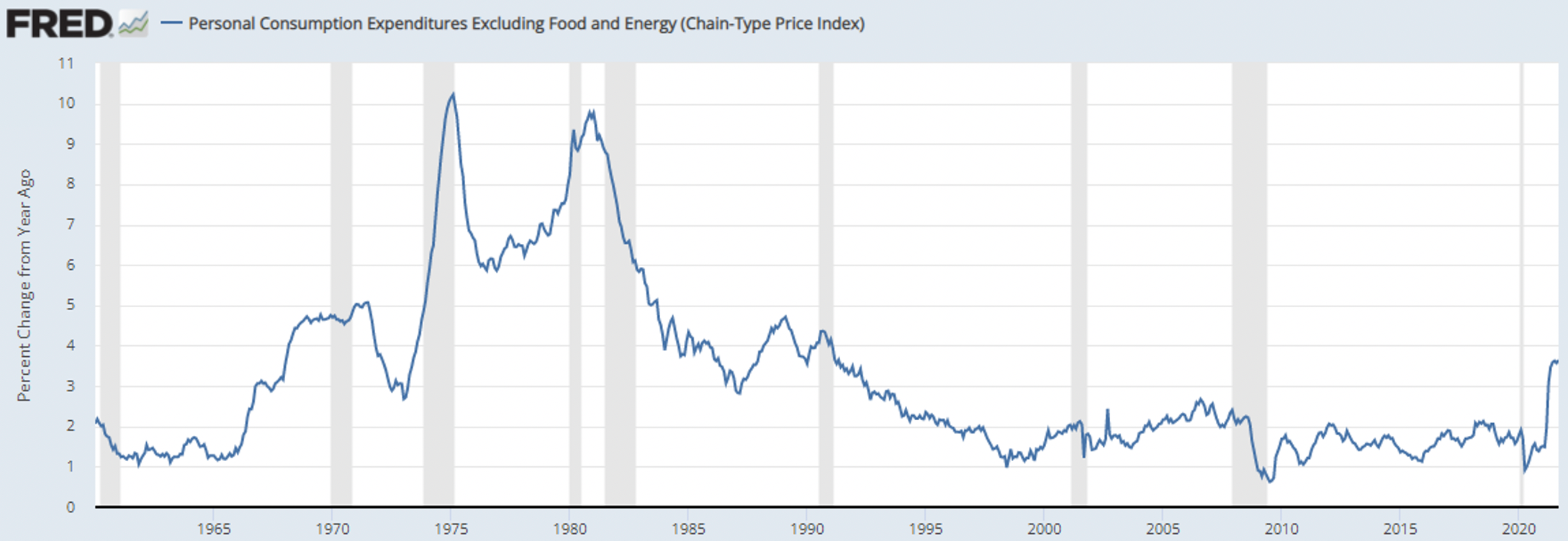

Elevated Price Pressures: Inflation remains at its highest level since the early 1990s

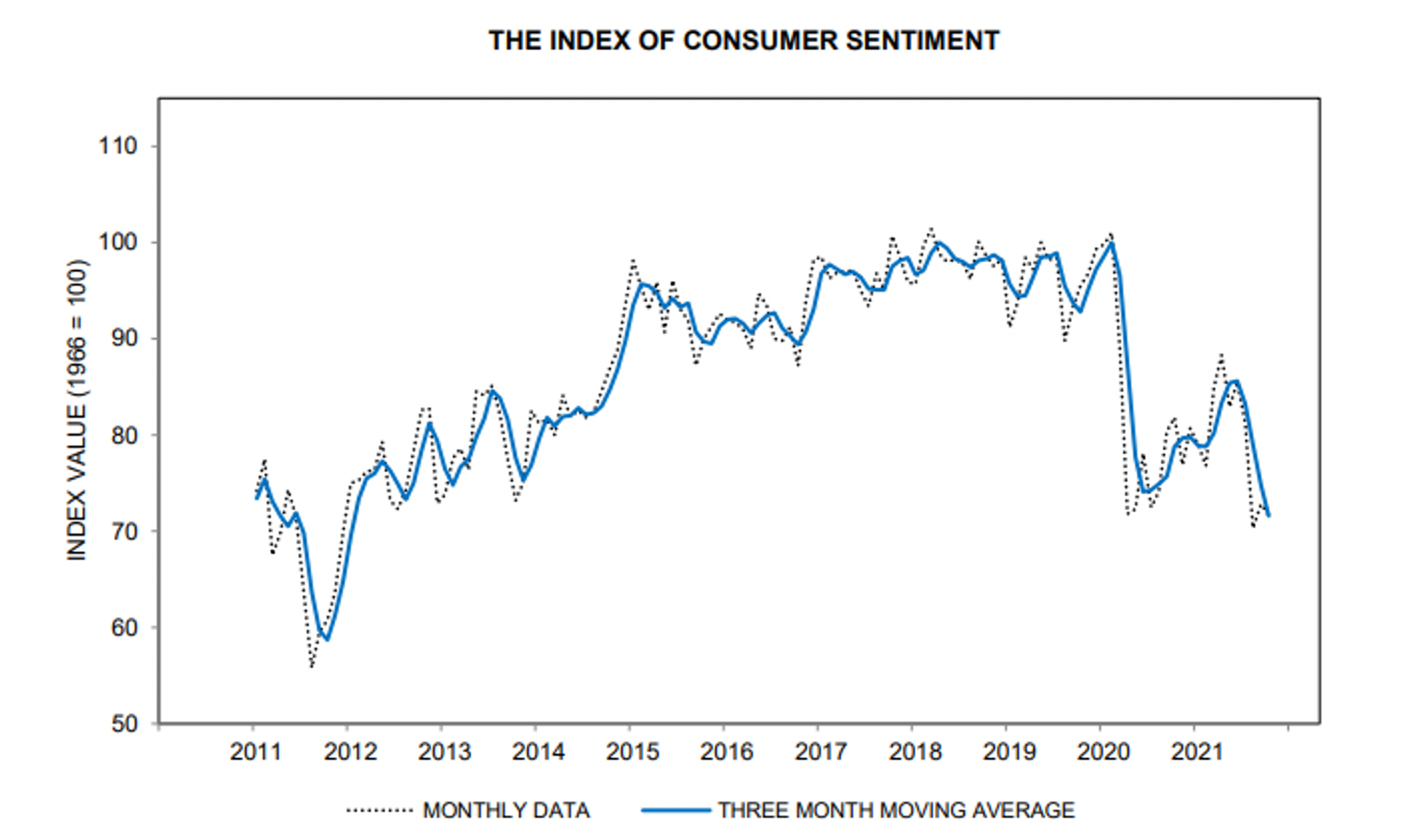

Weaker Confidence: Consumer sentiment (University of Michigan data) has fallen to near-decade lows, partially due to inflation concerns

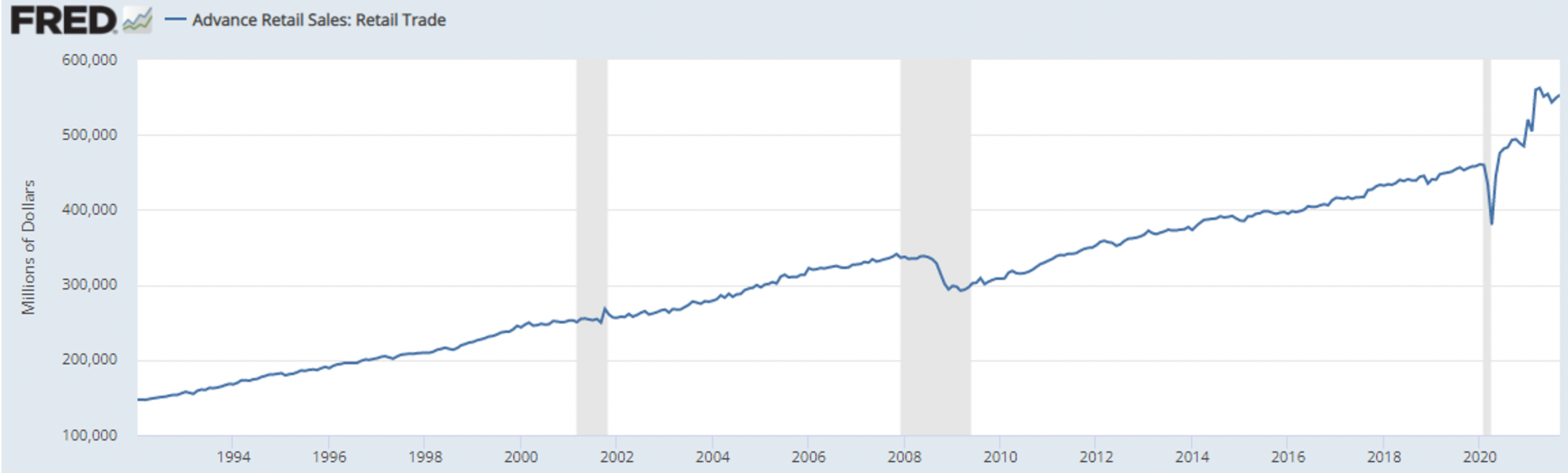

With regard to October's spending data, much of the commentary remains positive, evidenced by Retail Sales remaining well above its pre-COVID trend:

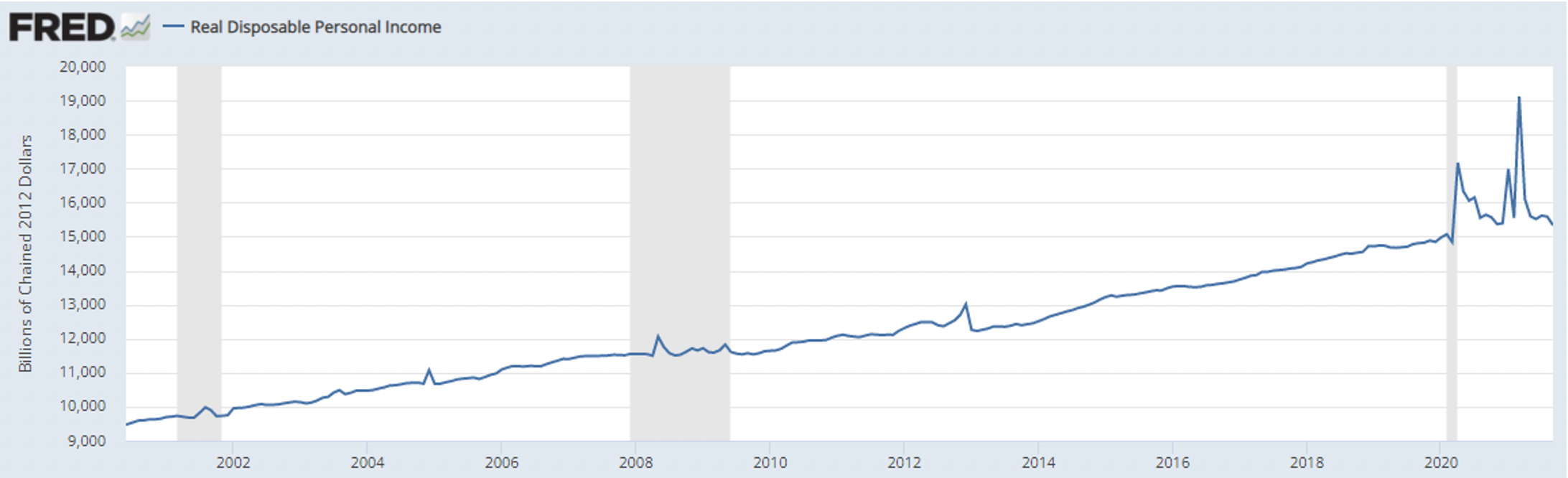

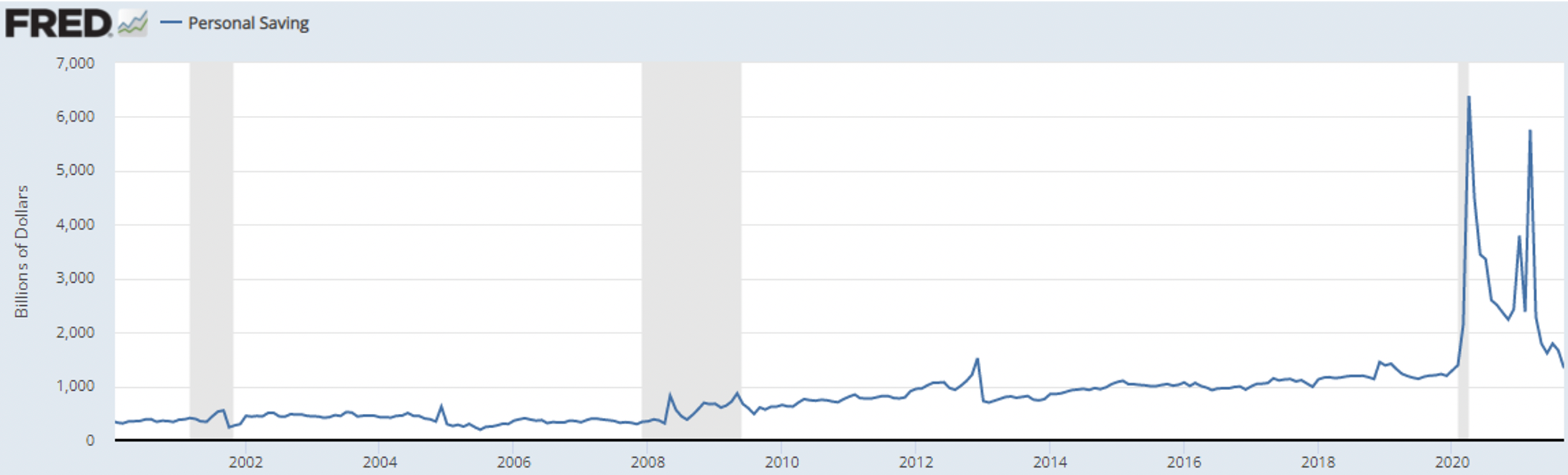

However, when you look at October's Personal Consumption Expenditures data, you see some trends that don’t look so promising. Income and Savings which have driven healthy spending levels, seem to be starting to fall below their pre-COVID trends.

This is a concern because many of the strong Income and Savings numbers throughout COVID were a direct result of stimulus efforts such as enhanced unemployment benefits and stimulus checks. Without these benefits, what happens to spending? Additionally, how does spending respond to rising prices for goods and services, particularly if it leads to the Fed removing accommodation more aggressively?

Keep an eye on personal Income and Savings over the next few months. Without substantial stimulus, these charts need to show stability for the recovery to continue in a healthy manner.