The economy’s engine is the job market. If the job market is strong, the public spends money. If the public spends money, businesses do well, and commercial real estate fundamentals improve. In the current environment, from my perspective, stronger jobs data matters more for the retail, multifamily, hotel, and industrial sectors than the office sector. More specifically, the work from home movement has increasingly become a key driver for office sector fundamentals, rather than the economy.

Looking at the data, we're able to report that this morning's job’s report was strong. Expectations were that about 700,000 jobs were created (recovered) in June. June’s report beat expectations with 850,000 jobs created.

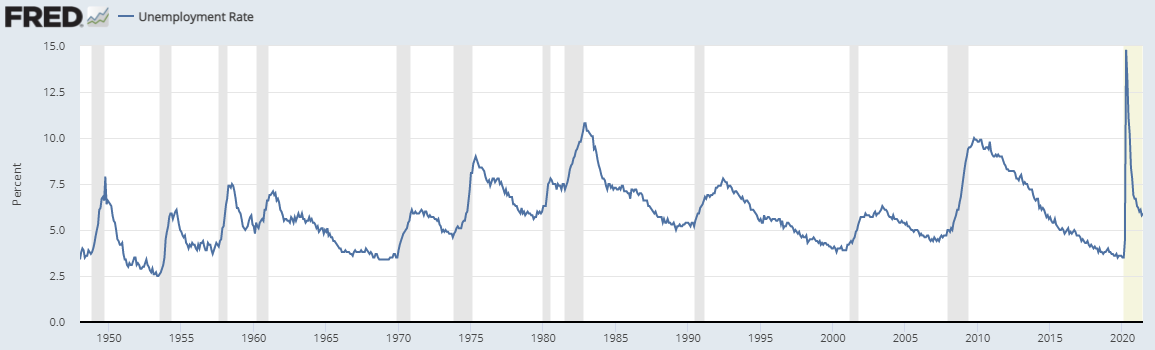

The unemployment rate is now back down to its historical average in the high 5% area:

Source: Federal Reserve Economic Data

Today’s report is most definitely a good sign for our recovery, but concerns remain for business across the US.

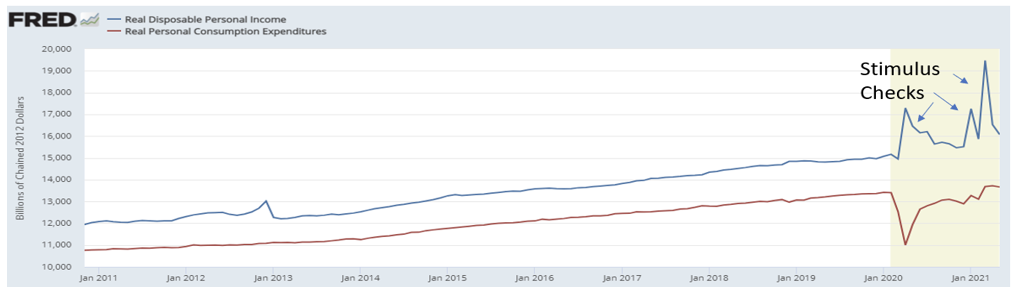

Much of spending has been supported by governmental stimulus which has almost run its course. As an example, unemployment benefits and direct stimulus checks had a massive impact on income and savings over the past year, but even in that environment, we were only able to get spending back to trend:

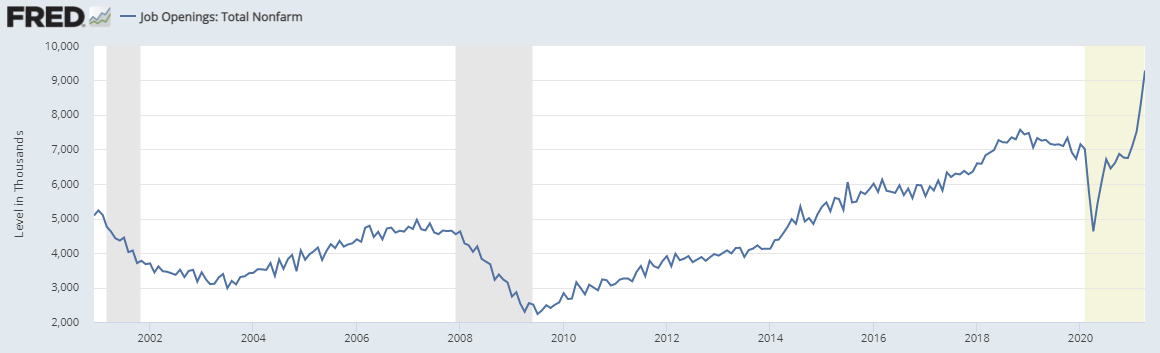

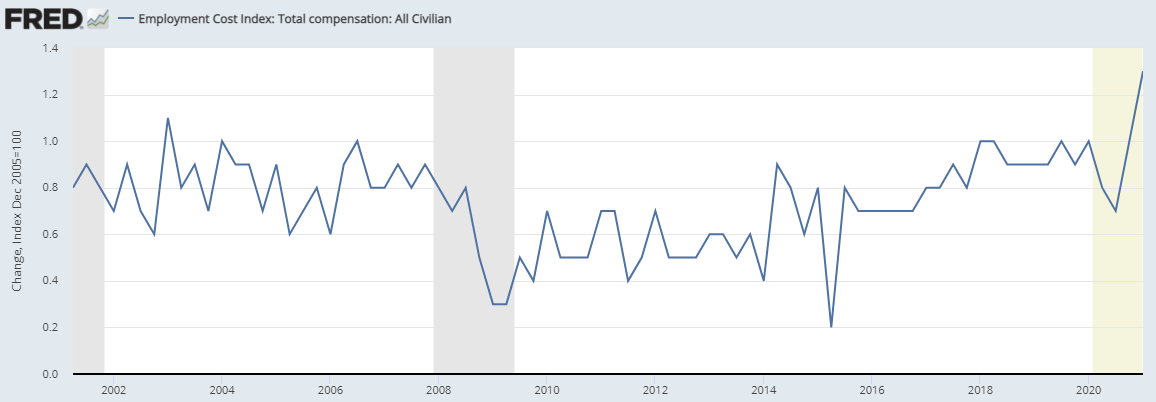

Source: Federal Reserve Economic DataBeyond concerns surrounding future spending, the employment story in the US is showing a lack of available labor which has helped (among other factors) lead to material inflation concerns. Looking at the labor story from this perspective, three charts that concern me include the Labor Force Participation Rate, the Job Opening and Labor Turnover Survey, and the Employment Cost Index. All three imply a lack of available labor.

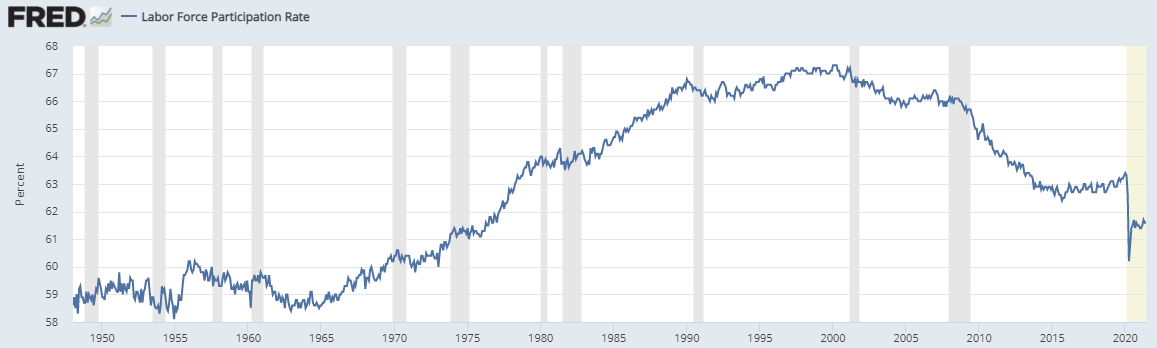

The Labor Force Participation Rate remains back down to 1970’s levels, and has shown virtually no improvement over the past 12 months:

Source: Federal Reserve Economic DataWe have a record number of job openings in the US (JOLT’s) report:

The Employment Cost Index is showing the highest costs for employers over the past 20 years:

From my perspective, I do think that as we get into the Fall of 2021, you will see some of these charts normalize a bit as additional unemployment benefits expire, forcing many back to work.

However, if inflationary pressures remain, and we don’t have stimulus to rely on, it looks like we have a worse economic environment for businesses than what we had pre-pandemic.